does tennessee have estate or inheritance tax

Under Tennessee law the inheritance tax was actually an estate tax a tax that was imposed on estates that. All inheritance are exempt in the State of Tennessee.

Any amount in excess of the federal exemption will be subject to estate tax.

. The Federal estate tax only affects02 of Estates. Under states that abide by community property law after one spouse passes away half of their estate immediately goes to their partner and the other half is distributed to other beneficiaries. Tennessee is not impose an estate tax.

States that collect an inheritance tax as of 2021 are Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Inheritance taxes are remitted by the recipient of a bequest and are thus based on the amount distributed to each beneficiary. As we have stated an estate tax is levied on the portion of an estate that exceeds the exclusion so there is just one instance of taxation.

It means that even if you are a Tennessee resident but have an estate in Kentucky your heirs will be. However it applies only to the estate physically located and transferred within the state between Tennessee residents. As of December 31 2015 the inheritance tax was eliminated in Tennessee.

How much can you inherit before you are taxed. Not many Tennessee estates have to pay the estate tax because the state offers a generous exemption for deaths occurring in 2015. Estate taxes are paid by the decedents estate before assets are distributed to heirs and are thus imposed on the overall value of the estate.

The estate tax is a tax on a persons assets after death. Even though Tennessee does not have an inheritance tax other states do. The inheritance tax is paid out of the.

How to Plan for the Inheritance Tax. Estate tax of 08 percent to 16 percent on estates above 5 million. Only those estates that are valued 5 million or more are subject to the Tennessee estate tax.

Iowa Kentucky Maryland Nebraska Pennsylvania and New Jersey are the only states with state-level inheritance taxes. Federal estatetrust income tax return. For all other estates subject to the inheritance tax for deaths that occurred before December 31 2015 the inheritance tax is paid by the executor administrator or trustee and it.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. Each has its own laws dictating who is exempt from the tax who will have to pay it and how much theyll have to pay. What Other Taxes Must be Paid.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. When there is an inheritance tax in place it can be levied on transfers to each individual inheritor. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

The possibility of the government taxing your hard-earned money after your death is a valid concern. All inheritance are exempt in the State of Tennessee. Tennessee estate tax.

But dont forget about the federal estate tax. Tennessee does not have an inheritance tax either. In fact it doesnt matter the size of your estate there will be no state level tax assessed.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. Inheritance taxes in Tennessee. See where your state shows up on the board.

Maryland imposes both an estate tax and an inheritance tax. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to their estates.

There are NO Tennessee Inheritance Tax. For example the neighboring state of Kentucky does have an inheritance tax. 08 percent to 16 percent on estates above 1 million Minnesota.

The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. Be aware of that your assets located in other states may be subject to that localitys inheritance or estate tax.

Tennessee repealed its estate tax confusingly called an inheritance tax by the state this year the culmination of a multi-year phase-out and Indiana completed the repeal of its inheritance tax in 2013. Federal state tax exemption. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. This is great news for residence. Any amount gifted to one person over that limit counts against your lifetime gift tax exemption of 1118 million.

The administrator of the estate must pay any. There are NO Tennessee Inheritance Tax. This is a type of inheritance law where each spouse automatically owns half of what they each obtained while married.

Tennessee does not have an inheritance tax either. Until this estate tax is phased out the minimum tax rate for estates larger than the exemption amount is 55 and the maximum remains 95. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than 12060000 for 2022.

13 percent to 16 percent on estates above 3 million. Technically Tennessee residents dont have to pay the inheritance tax. Some states have inheritance tax some have estate tax some have both some have none at all.

It also reduces your federal estate tax exemption. Inheritance tax of up to 10 percent Massachusetts. New York are in the process of phasing in new higher estate tax exemptions eventually matching the federal exemption level 59 million by 2019.

How does inheritance tax work in Tennessee.

How Much Is Inheritance Tax Probate Advance

Annuity Beneficiaries Inheriting An Annuity After Death

Tax Comparison Florida Verses Tennessee

Gift And Estate Tax Exclusions 2022 Cool Springs Law Firm Brentwood Tn

Tax Taxation Forms Of Escape From Taxation Computation Fiscal Pol

Types Of Taxes Income Property Goods Services Federal State

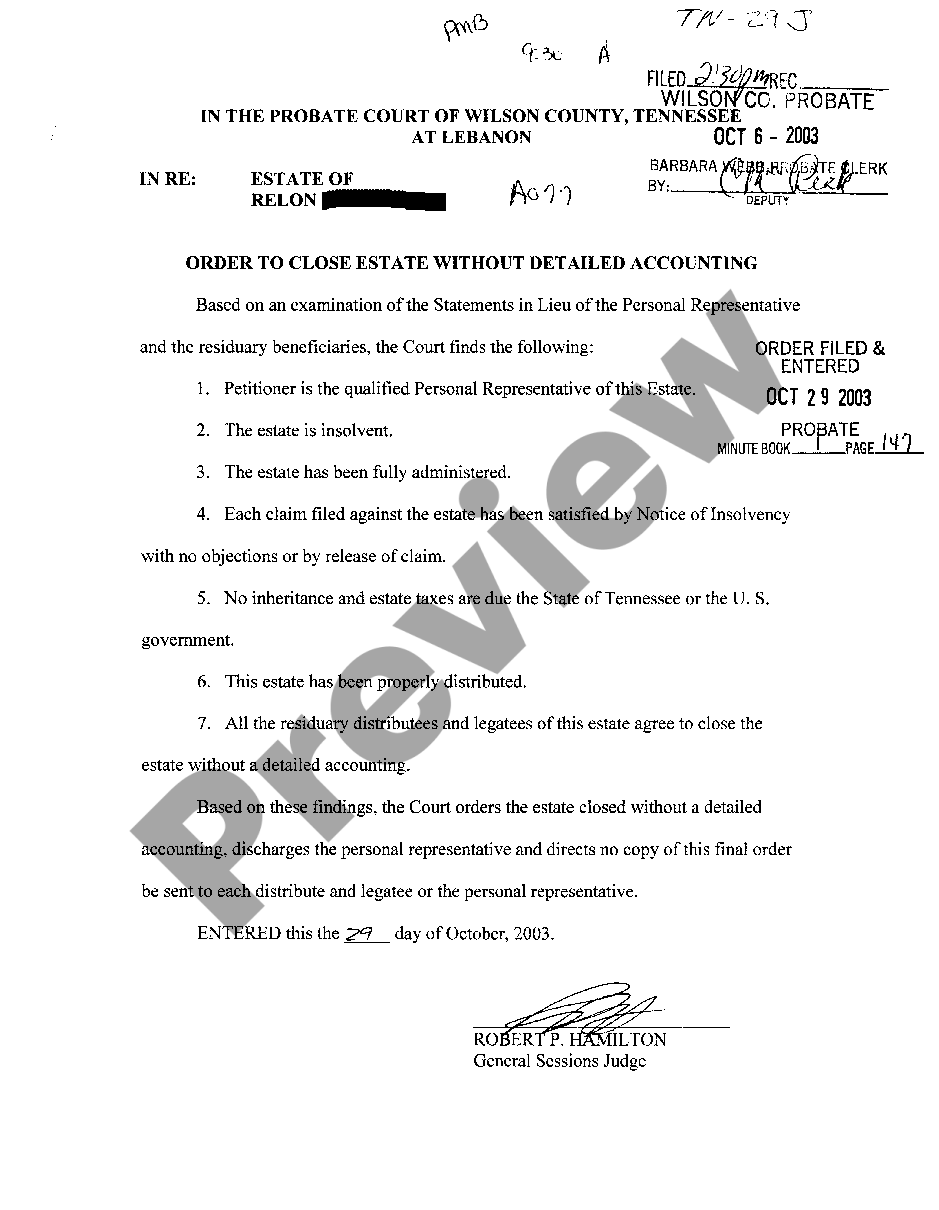

Tennessee Order To Close Estate Without Detailed Accounting Us Legal Forms

Is Your Inheritance Considered Taxable Income H R Block

Gift And Estate Tax Exclusions 2022 Cool Springs Law Firm Brentwood Tn

Where Not To Die In 2022 The Greediest Death Tax States

Alaska Probate Access Your Alaska Inheritance Immediately

Free Tennessee Wills And Codicils Pdf Word Free Printable Legal Forms

Where Not To Die In 2022 The Greediest Death Tax States

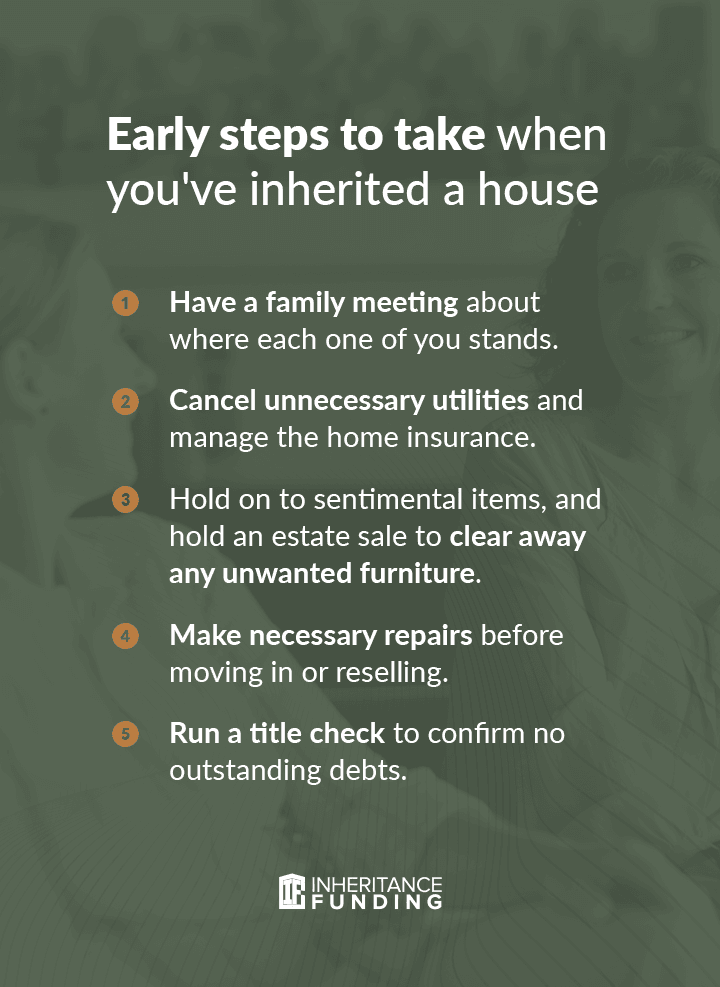

Guide To Inheriting A House With Siblings Inheritance Funding

How Much Is Inheritance Tax Probate Advance

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A